Tech Transfer, University Research & Business Opportunity

What is TURBO?

Tech Transfer, University Research and Business Opportunity

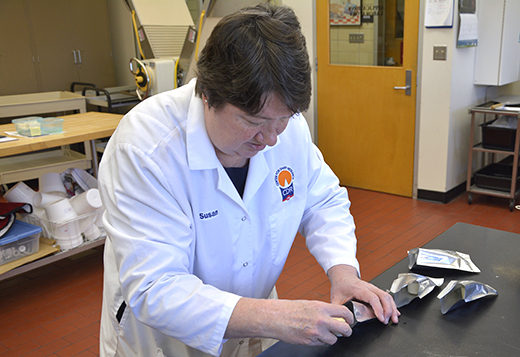

The TURBO program is CDR's unique not-for-profit, business accelerator program that supports entrepreneurs and small companies developing new, innovative foods or beverages that contain a dairy ingredient. Although there are a number of food and beverage accelerators available, TURBO is unique in its business model.

We emphasize working with aspiring entrepreneurs in developing their product ideas, assisting them in scale up processes and then helping them find co-packers or licensed space to produce their products on a commercial basis. Business assistance is available on an as needed basis. Using mostly free resources, TURBO clients can access business guidance and support when they are ready. Business services include business and marketing plan development, regulatory information, legal expertise, economic development, financing guidance and other resources.

TURBO provides it clients with a combination of product development services combined with business acumen. As part of the University of Wisconsin-Madison, we are a non-profit with access to a variety of experts. We stand by the maxim, "Your Success is Our Success."

“Your Success is Our Success”

Working with TURBO

Must Be Dairy-Based

CDR is committed to assisting the dairy products industry through its work across Education, Support, Innovation and Entrepreneurship. As part of this effort, we are available to assist with the product development and introduction of innovative products to the industry.

Before getting started there are some requirements in relation to the type of work what CDR can take on. As our major funding source comes from the Dairy Checkoff Program, we are limited to working with dairy products or products that have a dairy ingredient.

Our mission is based around improving the dairy products industry, therefore all work:

- Must be based on dairy (or contain a dairy ingredient).

- Demonstrate benefit to the Wisconsin and US dairy industry.

- Clients must be based in Wisconsin or the US.

Once these criteria are established, initiating work with CDR is not difficult.

Who We Work With

1. Entrepreneurs

(You have an idea and want help getting started).

We work with small entrepreneurs who require assistance getting their ideas up and running. Entrepreneurs cab utilize CDR's expertise and other campus resources to bring your idea to fruition. New product development is our forte, but we also have significant expertise in helping businesses get started.

2. Dairy Industry

(You are looking for innovation to boost your existing business).

We also independently develop and promote innovative research that has practical applications for the dairy industry. Companies looking for innovation can access technologies developed by CDR to add to their portfolio. Many of our technologies are patented and we work with the Wisconsin Alumni Research Foundation (WARF) to figure out the best way for you to access these technologies. with the resources they need to succeed.

“Vic Grassman [TURBO Manager] was a tremendous asset in providing information for market research, business plan development, dairy industry/ trends overview, buyer personas, sensory evaluation, value propositions and more.”

TURBO History

In 2012, CDR secured a $1 million grant. This was the first grant ever awarded to a Wisconsin entity for food and beverage innovation.

Read More

Success Story: TURBO Charging Speciality Cheese

The story of how CDR and TURBO helped a Wisconsin cheesemaker develop a world champion cheese.

Read More